International Consignment Agreement

From Supply Chain Management Encyclopedia

(/* Pattern Structure and Check-List for Designing International Consignment Agreement Compiled from the data from: Auerbach, R.Consignment Agreement Checklist, July 2003 - www.marketnewzealand.com/checklists. This article is construcned as a conversa) |

|||

| Line 149: | Line 149: | ||

* 12.3. Make sure that you "walk through" the Consignment Agreement with the person you select to manage the consignment relationship. Make sure that the person understands all of his or her responsibilities, the Consignee’s obligations and the potential risk areas. | * 12.3. Make sure that you "walk through" the Consignment Agreement with the person you select to manage the consignment relationship. Make sure that the person understands all of his or her responsibilities, the Consignee’s obligations and the potential risk areas. | ||

| + | '''13. Record Keeping and Reporting Requirements''' | ||

| + | |||

| + | * 13.1. Determine what records the Consignee should maintain. | ||

| + | |||

| + | 13.1.1. These records will be subject to your audit and inspection rights. (See clause 20 below.) | ||

| + | 13.1.2. If possible, the Consignee’s records should be in the same format as the records you keep in respect to your own stock. Describe your record keeping procedures and/or present your standard formats. | ||

| + | 13.1.3. It is likely that your record keeping procedures are on computer. If so, identify your hardware platform, operating system and application software for inventory control. | ||

| + | |||

| + | * 13.2. Determine the types of reports you require. | ||

| + | |||

| + | ** 13.2.1. As for the types of reports, you will certainly want to know the amount of Consignment Stock sold since the date of the previous report, the amount received since the date of the previous report and the amount of Consignment Stock on hand at any given point in time. | ||

| + | ** 13.2.2. You may also wish to know about the Consignee’s anticipated future requirements for Consignment Stock. | ||

| + | ** 13.2.3. Each report should reconcile with the previous report so that there is a clear paper trail. | ||

| + | ** 13.2.4. If you have a specific accounting format that you would like the Consignee to follow, attach it to the Agreement. | ||

| + | |||

| + | * 13.3. Frequency of reports. | ||

| + | |||

| + | ** 13.3.1. This will depend upon the amount of activity in the Consignment Stock. They don’t recommend less frequent than monthly even if there was little or no activity involving the Consignment Stock. | ||

| + | ** 13.3.2. If there is much activity involving the Consignment Stock, a weekly report might be appropriate. | ||

| + | |||

| + | '''14. Physical Stock Takes''' | ||

| + | |||

| + | * 14.1. The Consignment Stock should be subject to a physical stock take on a periodic basis. | ||

| + | |||

| + | ** 14.1.1. Determine how frequently the Consignee should undertake physical stock takes. | ||

| + | |||

| + | * 14.2. Who should do the stock take, the Consignee or the Consignee’s independent accountants? | ||

| + | * 14.3. The Consignor should receive notice of any physical stock take in case the Consignor wishes to attend. | ||

| + | * 14.4. Whether or not the Consignor attends, the Consignee should send the Consignor a copy of the final report. | ||

| + | * 14.5. The Consignee should be liable for any “inventory shrinkage.” | ||

| + | |||

| + | '''15. Consignment Stock Management''' | ||

| + | |||

| + | * 15.1. Depending upon the nature of the Consignment Stock, it may require special care and handling while in storage. | ||

| + | * 15.2. Describe any special care and handling instructions applicable to the Consignment Stock. | ||

| + | |||

| + | ** 15.2.1. If there isn’t enough room in the margin for this purpose, attach them as an exhibit to Agreement. | ||

| + | ** 15.2.2. The Consignment Agreement should impose an obligation upon the Consignee to comply with such care and handling instructions. | ||

| + | |||

| + | * 15.3. Are there any unusual storage specifications pertaining to the Consignment Stock (i.e. Temperature, humidity, storage life, etc.) | ||

| + | |||

| + | ** 15.3.1. If so, indicate such storage specifications in the Agreement. | ||

| + | |||

| + | * 15.4. What other stock management procedures do you wish to impose upon the Consignee (e.g. International Standards Organization 9002 standards)? | ||

| + | |||

| + | '''16. The Draw Down Procedure''' | ||

| + | |||

| + | * 16.1. Generally, the Consignor will want the Consignee to draw upon Consignment Stock on a first in first out (“FIFO”) basis. | ||

| + | |||

| + | ** 16.1.1. If you wish to stipulate a different draw down procedure, indicate it in the Agreement. | ||

| + | |||

| + | * 16.2. If the Consignee holds stock that it has bought outright, the Consignee will naturally favor that stock over the Consignment Stock. | ||

| + | |||

| + | ** 16.2.1. In order to discourage this, the Consignment Agreement normally provides that the Consignee must draw down Consignment Stock before using its own stock. | ||

| + | |||

| + | * 16.3. The Consignee must notify the Consignor as and when the Consignee draws down Consignment Stock. It is referred to as “Draw Down Notice.” | ||

| + | |||

| + | ** 16.3.1. The parties should agree upon the form of Draw Down Notice. | ||

| + | |||

| + | '''17. The Replenishment Procedure''' | ||

| + | |||

| + | * 17.1. Except in the case of a “one off” transaction, a Consignor will normally replenish Consignment Stock as the Consignee draws down Consignment Stock. | ||

| + | |||

| + | ** 17.1.1. The Consignee will place additional orders on the Consignor for Consignment Stock. The Consignor will then issue a confirmation in much the same way as it would do in a traditional purchase and sale transaction. | ||

| + | |||

| + | * 17.2. The Consignor may wish to limit its exposure by specifying a maximum limit to the amount of Consignment Stock held at any given time by the Consignee. | ||

| + | |||

| + | ** 17.2.1. You have to specify such a maximum limit in the Agreement. | ||

| + | |||

| + | * 17.3. In the Agreement, stipulate the key operational elements of your Consignment Stock replenishment program focusing upon the key differences with your standard ordering procedure. | ||

| + | |||

| + | '''18. The Price of the Consignment Stock''' | ||

| + | |||

| + | * 18.1. State the price of the Consignment Stock in the Agreement. Alternatively, you may attach as an Appendix the Agreement. | ||

| + | * 18.2. In a typical Consignment Agreement, the Consignor cannot increase the price of Consignment Stock already in the hands of the Consignee. However, the Consignor may institute a price increase in respect to future shipments of Consignment Stock. | ||

| + | |||

| + | ** 18.2.2. Stipulate in the Agreement if your arrangement differs from the norm. | ||

| + | |||

| + | '''19. The Payment Terms''' | ||

| + | |||

| + | * 19.1. In a Consignment Stock Agreement, the Consignor can normally demand stricter payment terms. | ||

| + | |||

| + | ** 19.1.1. This is to compensate the Consignor for financing the Consignee’s inventory and assuming the risks inherent in a consignment relationship. | ||

| + | ** 19.1.2. Indicate your payment terms in the Agreement. | ||

| + | |||

| + | * 19.2. Determine the relevant payment cycle. | ||

| + | |||

| + | 19.2.1. You can provide for payment so many days after each sale. This is generally too cumbersome when dealing with large quantities of fast moving stock. | ||

| + | 19.2.2. You can provide for payment on a periodic basis (ie. Weekly, fortnightly monthly or quarterly). This is the preferred method. | ||

| + | 19.2.3. Here is a common clause in a Consignment Agreement relating to payment: “By the _____ day following each _______ during the term of this Consignment Agreement, the Consignee shall render a full accounting of all Consignment Stock sold by it during such period and shall pay the Consignor the purchase price for such Consignment Stock.” | ||

| + | 19.2.4. Indicate your payment arrangements in the margin. | ||

| + | |||

| + | * 19.3. Do you wish to provide for self-generated invoices? <ref>That is to say, the Consignee issues the invoices to itself (on behalf of the Consignor) as and when the Consignee draws down the Consignment Stock. </ref> | ||

| + | * 19.4. In a Consignment Stock Agreement, the Consignee normally bears the full credit risk of its customers just as it would in a conventional purchase and sale arrangement. Thus, the Consignor normally receives payment from the Consignee, whether or not the Consignee has received payment from its customer. The Consignee holds all proceeds from the sale of Consignment Stock in trust. The beneficiary of such trust is the Consignor. This fiduciary obligation continues until such time as the Consignee has paid the Consignor in full. | ||

| + | |||

| + | ** 19.4.1. The Consignment Agreement must expressly state this. Otherwise, if a bad debt arises, the Consignee may argue that it was acting as your agent. The Consignee may claim that, as your agent, it was selling for your risk and account! | ||

| + | ** 19.4.2. Stipulate in the Agreement if your understanding with the Consignee varies from the norm as stated above. | ||

| + | |||

| + | * 19.5. Normally, the Consignee has the absolute right to sell the Consignment Stock at such prices and upon such terms as it may set. | ||

| + | |||

| + | ** 19.5.1. Stipulate in the Agreement if your understanding with the Consignee varies from the norm as stated above. | ||

| + | |||

| + | '''20. Audit and Inspection Rights''' | ||

| + | |||

| + | * 20.1. In a Consignment Stock Agreement, the Consignee normally grants the Consignor extremely broad audit and inspection rights. This is appropriate because the Consignment Stock belongs to the Consignor. | ||

| + | |||

| + | ** 20.1.1. Thus, the Consignor may inspect the Consignment Stock during regular business hours, with or without notice to the Consignor. | ||

| + | ** 20.1.2. As for the right to audit the Consignee’s books and records, it is acceptable practice to give the Consignee some notice. | ||

| + | |||

| + | * 20.2. If your audit and inspection rights vary from the norm, note the differences in the margin. | ||

| + | |||

| + | '''21. Removal Rights''' | ||

| + | |||

| + | * 21.1. In a Consignment Stock Agreement, the Consignee normally grants the Consignor extremely broad removal rights. | ||

| + | |||

| + | ** 21.1.1. Thus, the Consignor may enter upon the Consignee’s premises and remove all or any part of the Consignment Stock during regular business hours, with or without notice to the Consignee, and with or without cause. | ||

| + | ** 21.1.2. The Consignor would assume liability for any damage caused to the Consignee’s property during the removal process. | ||

| + | ** 21.1.3. If your removal rights vary from the norm, note the differences in the margin. | ||

| + | |||

| + | * 21.2. Occasionally, the Consignment Agreement will give the Consignee a right of first refusal to purchase on the spot, for cash, any Consignment Stock prior to its removal by the Consignor. | ||

| + | |||

| + | ** 21.2.1. In such a situation, normal payment terms would not apply as one would assume that the Consignor is removing the Consignment Stock as a matter of urgency. | ||

| + | ** 21.2.2. Do you wish to grant the Consignee a right of first refusal to buy the Consignment Stock prior to its removal? | ||

| + | |||

| + | '''24. Term of Consignment Agreement''' <ref> Items ## 22, 23, 25-28 are omitted herein (partly, due their New Zeeland specifics) but could be easily got to by using the following reference: www.marketnewzealand.com/checklists </ref> | ||

| + | |||

| + | * 24.1. A Consignment Agreement is usually a temporary relationship. It does not go on forever. At some stage, the parties should convert to a more conventional relationship. | ||

| + | * 24.2. What is the term of the Consignment Agreement? | ||

| + | |||

| + | ** 24.2.1. For example, you can say: “_____ months or when all the Consignment Stock is sold, whichever occurs first.” | ||

| + | |||

| + | * 24.3. What happens to any Consignment Stock remaining unsold at the end of the term of the Consignment Agreement? | ||

| + | |||

| + | ** 24.3.1. Normally, the Consignee shall either pay for any Consignment Stock that it may then wish to keep or return such unsold Consignment Stock to the Consignor. | ||

| + | |||

| + | * 24.4. As to any Consignment Stock that the Consignee does not wish to buy, who pays the cost of shipping such Consignment Stock back to the Consignor? | ||

| + | |||

| + | ** 24.4.1. There is no norm here. It is purely a matter of negotiation between the Consignor and the Consignee. | ||

==References== | ==References== | ||

Revision as of 00:28, 12 November 2014

Russian: Международное консигнационное соглашение

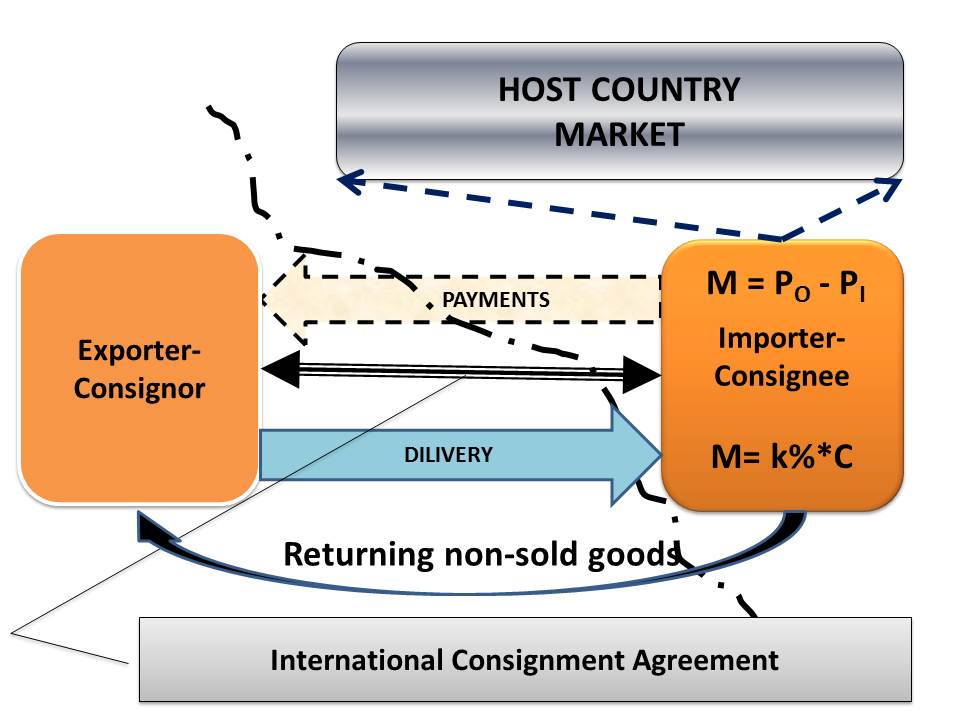

Consignment in international trade is a variation of the open account method of payment in which payment is sent to the exporter only after the goods have been sold by the foreign distributor to the end customer[1]. An international consignment transaction is based on a contractual arrangement in which the foreign distributor receives, manages, and sells the goods for the exporter who retains title to the goods until they are sold. Payment to the exporter is required only for those items sold. One of the common uses of consignment in exporting is the sale of heavy machinery and equipment because the foreign distributor generally needs floor models and inventory for sale. Goods not sold after an agreed upon time period may be returned to the exporter at cost. Exporting on consignment is very risky as the exporter is not guaranteed any payment and someone outside the exporter’s control has actual possession of its inventory. However, selling on consignment can provide the exporter some great advantages which may not be obvious at first glance. For example, consignment can help exporters compete on the basis of better availability and faster delivery of goods when they are stored near the end customer. It can also help exporters reduce the direct costs of storing and managing inventory, thereby making it possible to keep selling prices in the local market competitive. However, though consignment can definitely enhance export competitiveness, exporters should keep in mind that the key to success in exporting on consignment and in getting paid is to partner with a reputable and trustworthy foreign distributor or a third-party logistics provider.

Simplified Scheme of Relationship of Parties in International Consignment Agreement

LEGEND:

- in the case of non-returnable consignment (М = PO – PI = OUTBOUND PRICE – INBOUND PRICE);

- in the case of returnable consignment (М = k*C = COMISSION INTEREST * COST OF CONSIGNMENT PRODUCT SOLD).

Pattern Structure and Check-List for Designing International Consignment Agreement[2]

1. Definitions

- 1.1. “Consignee” refers to the customer who receives the Consignment Stock subject to the terms of the Consignment Agreement.

- 1.2. “Consignment Stock” refers to the manufacturer’s (reseller’s) products that are the subject of the Consignment Agreement.

- 1.3. “Consignor” refers to the manufacturer whose products are the subject of the Consignment Agreement.

2. Details about the Consignee

- 2.1. In the margin, provide full details about the Consignee including name, address, telephone, e-mail (fax) and contact person.

3. Due Diligence about the Consignee

- 3.1. If the Consignee is a new customer, there are various types of “corporate intelligence” that you should consider:

- 3.1.1. Financial statements.

- 3.1.2. Credit check (eg. Dunn & Bradstreet).

- 3.1.3. Lien search.

- 3.1.4. Bank references.

- 3.1.5. Trade references.

- 3.1.6. History of the company.

- 3.1.7. Background of its management.

- 3.2. Has the Consignee ever entered into a Consignment Agreement before?

- 3.2.1. If so, get the contact details for any other Consignors with whom the Consignee has previously dealt.

4. Purpose of the Consignment Agreement

- 4.1. Different legal and commercial considerations flow from the purpose of the agreement.

- 4.1.1. Is the purpose of the Consignment Agreement to provide a quantity of “buffer stock” to smooth out seasonal fluctuations in demand and to avoid “out of stock” situations?

- 4.1.2. Is the purpose to provide your customer with an inventory financing facility?

- 4.2. Describe the purpose of this Consignment Agreement.

- 4.2.1. At whose behest are we writing this agreement, your's or your customer's?

- 4.2.2. Why do we need a Consignment Agreement?

- 4.2.3. Aren’t there any other means of achieving the parties’ objectives short of a consignment arrangement with all its legal and commercial risks?

- 4.2.4. Can you make less drastic alterations to conventional terms and thereby avoid the need for a consignment arrangement? (eg. You may offer more generous credit terms, a more generous “return’s policy”, allowances for slow moving stock, incentives to buy sufficient stock for a balanced inventory, storage of the goods in a public warehouse in the Consignor’s name or perhaps a “garden variety” agency relationship.)

5. The Consignment Stock

- 5.1. It’s necessary to stipulate a detailed schedule of the Consignment Stock.

- 5.1.1. Your schedule should include as much detail as possible given the nature of the goods. (ie. Factory codes, serial numbers, lot numbers, model and style numbers, etc.)

- 5.2. Indicate whether this is a “one off” transaction or whether you intend to replenish the Consignment Stock as the Consignee sells it.

6. Storage Considerations

- 6.1. In a typical Consignment Agreement, the Consignee will store and insure the Consignment Stock at the Consignee’s expense.

- 6.1.1. Is that true in this case? If not, please indicate any differences in your arrangements with the Consignee.

- 6.2. Since you, the Consignor, own the Consignment Stock, you will want to ensure that the Consignee provides adequate storage facilities.

- 6.2.1. Have you inspected the Consignee’s storage facility?

- 6.3. Will the Consignee segregate the Consignment Stock from its other stock? If so, what means of segregation will the Consignee employ?

- 6.3.1. Cordoning off.

- 6.3.2. Signs.

- 6.3.3. Separate room with lock.

- 6.3.4. Separate facility.

- 6.4. Will the Consignee co-mingle the Consignment Stock with other stock?

- 6.4.1. If so, see clause 7 regarding the need to distinguish Consignment Stock from non-Consignment Stock.

- 6.5. In a typical Consignment Agreement, the Consignee has no right to move the Consignment Stock, except in connection with a sale to a customer. What this means is that the Consignee cannot move the Consignment Stock to a different storage facility or to a different area within the same storage facility, without the Consignor’s prior written consent. WHY???

- 6.5.1. If your arrangements with the Consignee are different from the norm, please so indicate in the margin.

7. Distinguishing Consignment Stock from Other Stock

- 7.1. Do you intend to sell all stock on a consignment basis or will you be selling some stock on a more traditional basis?

- 7.1.1. If the latter, how will you distinguish a consignment sale from an ordinary sale?

- 7.2. Will the Consignee co-mingle Consignment Stock with other stock that the Consignee has bought outright?

- 7.2.1. Once again, how will you distinguish the Consignment Stock from the Consignee’s other stock?

- 7.2.2. Can you implement some sort of marking procedure? Even where the Consignee has committed to segregate Consignment Stock from its other stock, it is helpful to establish a procedure for its ready identification

8. Insurance Considerations

- 8.1. Some products liability insurance policies restrict overseas warehousing operations by the insured. Check your policy to determine whether a Consignment Stock arrangement will invalidate it.

- 8.2. What other insurance cover does the Consignee have (ie. Fire, theft, accidents)?

- 8.2.1. Check the policy terms to make sure that they cover the Consignment Stock. Some policies may not cover assets that the insured party doesn’t own.

- 8.2.2. The Consignment Agreement will require the Consignee to provide the Consignor with certificates of insurance on an annual basis

- 8.3. If possible, the Consignee should amend its policies in two respects:

- 8.3.1. The policy should name the Consignor as an additional insured party in respect to the Consignment Stock.

- 8.3.2. The insurance company should provide the Consignor with notice of cancellation or termination so that the Consignor can arrange other insurance cover.

- 8.4. Check your own insurance policies to determine whether they would cover your Consignment Stock.

9. Risk of Loss or Damage

- 9.1. Notwithstanding the fact that the Consignor retains title to the Consignment Stock, the Consignee normally bears the risk of loss and damage to the Consignment Stock. The Consignee is responsible for any loss or damage to the Consignment Stock after the risk of loss and damage has passed from the Consignor to the Consignee.

- 9.2. Exactly when the risk of loss and damage passes from the Consignor to the Consignee depends upon the shipping terms the parties select.

- 9.2.1. For example, if the shipping terms are FOB, risk of loss would pass the moment the goods are on the board of the ship.

- 9.2.2. What shipping terms will govern this agreement?

- 9.3. The Consignee should promptly notify the Consignor in the event that any of the Consignment Stock arrives in damaged condition or if the quantity does not conform with the shipping documents.

- 9.3.1. Absent such notice, the Consignor shall deem that the Consignee accepted the Consignment Stock in the quantity stated on the shipping documents and in good condition.

10. Security

- 10.1. According to the law of most jurisdictions, you don’t need to take a security interest in your own stock. However, some jurisdictions have filing requirements, the purpose of which is to keep third parties apprised that the Consignee doesn’t own the Consignment Stock.

- 10.2. In addition, you may wish to take a security interest in the Consignee’s “other” assets to offset the risks inherent in a consignment relationship.

- 10.2.1. At one end of the spectrum, the security interest might only cover the “debts” created through the sale of Consignment Stock.

- 10.2.2. At the other end of the spectrum, the security interest might cover assets unrelated to the Consignment Stock, both tangible and intangible.

- 10.3. Personal guarantees are another option[3].

11. The Consignee’s Agent

- 11.1. The security of your Consignment Stock largely depends upon placing your trust in human beings.

- 11.2. The Consignee should appoint one individual to manage the consignment relationship. Although this individual will normally be on the payroll of the Consignee, he should be a person of unquestioned integrity, a person in whom the Consignor has confidence

12. The Consignor’s Agent

- 12.1. Your agent would normally be the person on your staff who handles the credit management function for your company. It could also be a staff accountant or perhaps your company secretary.

- 12.2. Sound credit management, as we all know, means staying right on top of the debtor. The same applies to a consignment arrangement.

- 12.3. Make sure that you "walk through" the Consignment Agreement with the person you select to manage the consignment relationship. Make sure that the person understands all of his or her responsibilities, the Consignee’s obligations and the potential risk areas.

13. Record Keeping and Reporting Requirements

- 13.1. Determine what records the Consignee should maintain.

13.1.1. These records will be subject to your audit and inspection rights. (See clause 20 below.) 13.1.2. If possible, the Consignee’s records should be in the same format as the records you keep in respect to your own stock. Describe your record keeping procedures and/or present your standard formats. 13.1.3. It is likely that your record keeping procedures are on computer. If so, identify your hardware platform, operating system and application software for inventory control.

- 13.2. Determine the types of reports you require.

- 13.2.1. As for the types of reports, you will certainly want to know the amount of Consignment Stock sold since the date of the previous report, the amount received since the date of the previous report and the amount of Consignment Stock on hand at any given point in time.

- 13.2.2. You may also wish to know about the Consignee’s anticipated future requirements for Consignment Stock.

- 13.2.3. Each report should reconcile with the previous report so that there is a clear paper trail.

- 13.2.4. If you have a specific accounting format that you would like the Consignee to follow, attach it to the Agreement.

- 13.3. Frequency of reports.

- 13.3.1. This will depend upon the amount of activity in the Consignment Stock. They don’t recommend less frequent than monthly even if there was little or no activity involving the Consignment Stock.

- 13.3.2. If there is much activity involving the Consignment Stock, a weekly report might be appropriate.

14. Physical Stock Takes

- 14.1. The Consignment Stock should be subject to a physical stock take on a periodic basis.

- 14.1.1. Determine how frequently the Consignee should undertake physical stock takes.

- 14.2. Who should do the stock take, the Consignee or the Consignee’s independent accountants?

- 14.3. The Consignor should receive notice of any physical stock take in case the Consignor wishes to attend.

- 14.4. Whether or not the Consignor attends, the Consignee should send the Consignor a copy of the final report.

- 14.5. The Consignee should be liable for any “inventory shrinkage.”

15. Consignment Stock Management

- 15.1. Depending upon the nature of the Consignment Stock, it may require special care and handling while in storage.

- 15.2. Describe any special care and handling instructions applicable to the Consignment Stock.

- 15.2.1. If there isn’t enough room in the margin for this purpose, attach them as an exhibit to Agreement.

- 15.2.2. The Consignment Agreement should impose an obligation upon the Consignee to comply with such care and handling instructions.

- 15.3. Are there any unusual storage specifications pertaining to the Consignment Stock (i.e. Temperature, humidity, storage life, etc.)

- 15.3.1. If so, indicate such storage specifications in the Agreement.

- 15.4. What other stock management procedures do you wish to impose upon the Consignee (e.g. International Standards Organization 9002 standards)?

16. The Draw Down Procedure

- 16.1. Generally, the Consignor will want the Consignee to draw upon Consignment Stock on a first in first out (“FIFO”) basis.

- 16.1.1. If you wish to stipulate a different draw down procedure, indicate it in the Agreement.

- 16.2. If the Consignee holds stock that it has bought outright, the Consignee will naturally favor that stock over the Consignment Stock.

- 16.2.1. In order to discourage this, the Consignment Agreement normally provides that the Consignee must draw down Consignment Stock before using its own stock.

- 16.3. The Consignee must notify the Consignor as and when the Consignee draws down Consignment Stock. It is referred to as “Draw Down Notice.”

- 16.3.1. The parties should agree upon the form of Draw Down Notice.

17. The Replenishment Procedure

- 17.1. Except in the case of a “one off” transaction, a Consignor will normally replenish Consignment Stock as the Consignee draws down Consignment Stock.

- 17.1.1. The Consignee will place additional orders on the Consignor for Consignment Stock. The Consignor will then issue a confirmation in much the same way as it would do in a traditional purchase and sale transaction.

- 17.2. The Consignor may wish to limit its exposure by specifying a maximum limit to the amount of Consignment Stock held at any given time by the Consignee.

- 17.2.1. You have to specify such a maximum limit in the Agreement.

- 17.3. In the Agreement, stipulate the key operational elements of your Consignment Stock replenishment program focusing upon the key differences with your standard ordering procedure.

18. The Price of the Consignment Stock

- 18.1. State the price of the Consignment Stock in the Agreement. Alternatively, you may attach as an Appendix the Agreement.

- 18.2. In a typical Consignment Agreement, the Consignor cannot increase the price of Consignment Stock already in the hands of the Consignee. However, the Consignor may institute a price increase in respect to future shipments of Consignment Stock.

- 18.2.2. Stipulate in the Agreement if your arrangement differs from the norm.

19. The Payment Terms

- 19.1. In a Consignment Stock Agreement, the Consignor can normally demand stricter payment terms.

- 19.1.1. This is to compensate the Consignor for financing the Consignee’s inventory and assuming the risks inherent in a consignment relationship.

- 19.1.2. Indicate your payment terms in the Agreement.

- 19.2. Determine the relevant payment cycle.

19.2.1. You can provide for payment so many days after each sale. This is generally too cumbersome when dealing with large quantities of fast moving stock. 19.2.2. You can provide for payment on a periodic basis (ie. Weekly, fortnightly monthly or quarterly). This is the preferred method. 19.2.3. Here is a common clause in a Consignment Agreement relating to payment: “By the _____ day following each _______ during the term of this Consignment Agreement, the Consignee shall render a full accounting of all Consignment Stock sold by it during such period and shall pay the Consignor the purchase price for such Consignment Stock.” 19.2.4. Indicate your payment arrangements in the margin.

- 19.3. Do you wish to provide for self-generated invoices? [4]

- 19.4. In a Consignment Stock Agreement, the Consignee normally bears the full credit risk of its customers just as it would in a conventional purchase and sale arrangement. Thus, the Consignor normally receives payment from the Consignee, whether or not the Consignee has received payment from its customer. The Consignee holds all proceeds from the sale of Consignment Stock in trust. The beneficiary of such trust is the Consignor. This fiduciary obligation continues until such time as the Consignee has paid the Consignor in full.

- 19.4.1. The Consignment Agreement must expressly state this. Otherwise, if a bad debt arises, the Consignee may argue that it was acting as your agent. The Consignee may claim that, as your agent, it was selling for your risk and account!

- 19.4.2. Stipulate in the Agreement if your understanding with the Consignee varies from the norm as stated above.

- 19.5. Normally, the Consignee has the absolute right to sell the Consignment Stock at such prices and upon such terms as it may set.

- 19.5.1. Stipulate in the Agreement if your understanding with the Consignee varies from the norm as stated above.

20. Audit and Inspection Rights

- 20.1. In a Consignment Stock Agreement, the Consignee normally grants the Consignor extremely broad audit and inspection rights. This is appropriate because the Consignment Stock belongs to the Consignor.

- 20.1.1. Thus, the Consignor may inspect the Consignment Stock during regular business hours, with or without notice to the Consignor.

- 20.1.2. As for the right to audit the Consignee’s books and records, it is acceptable practice to give the Consignee some notice.

- 20.2. If your audit and inspection rights vary from the norm, note the differences in the margin.

21. Removal Rights

- 21.1. In a Consignment Stock Agreement, the Consignee normally grants the Consignor extremely broad removal rights.

- 21.1.1. Thus, the Consignor may enter upon the Consignee’s premises and remove all or any part of the Consignment Stock during regular business hours, with or without notice to the Consignee, and with or without cause.

- 21.1.2. The Consignor would assume liability for any damage caused to the Consignee’s property during the removal process.

- 21.1.3. If your removal rights vary from the norm, note the differences in the margin.

- 21.2. Occasionally, the Consignment Agreement will give the Consignee a right of first refusal to purchase on the spot, for cash, any Consignment Stock prior to its removal by the Consignor.

- 21.2.1. In such a situation, normal payment terms would not apply as one would assume that the Consignor is removing the Consignment Stock as a matter of urgency.

- 21.2.2. Do you wish to grant the Consignee a right of first refusal to buy the Consignment Stock prior to its removal?

24. Term of Consignment Agreement [5]

- 24.1. A Consignment Agreement is usually a temporary relationship. It does not go on forever. At some stage, the parties should convert to a more conventional relationship.

- 24.2. What is the term of the Consignment Agreement?

- 24.2.1. For example, you can say: “_____ months or when all the Consignment Stock is sold, whichever occurs first.”

- 24.3. What happens to any Consignment Stock remaining unsold at the end of the term of the Consignment Agreement?

- 24.3.1. Normally, the Consignee shall either pay for any Consignment Stock that it may then wish to keep or return such unsold Consignment Stock to the Consignor.

- 24.4. As to any Consignment Stock that the Consignee does not wish to buy, who pays the cost of shipping such Consignment Stock back to the Consignor?

- 24.4.1. There is no norm here. It is purely a matter of negotiation between the Consignor and the Consignee.

References

- ↑ Chapter 6: Consignment - http://www.export.gov/tradefinanceguide/eg_main_043248.asp

- ↑ Compiled from the data from: Auerbach, R.Consignment Agreement Checklist, July 2003 - www.marketnewzealand.com/checklists. This article is construcned as a conversation between a consultant and Consignor who is going to conclude an International Consignment Agreement with a possible Consignee.

- ↑ However, if you have to bolster your security from the Consignee with personal guarantees from its principals, which sends a clear warning that a consignment relationship may be too risky.

- ↑ That is to say, the Consignee issues the invoices to itself (on behalf of the Consignor) as and when the Consignee draws down the Consignment Stock.

- ↑ Items ## 22, 23, 25-28 are omitted herein (partly, due their New Zeeland specifics) but could be easily got to by using the following reference: www.marketnewzealand.com/checklists