Incremental Discounts

From Supply Chain Management Encyclopedia

| Line 1: | Line 1: | ||

In the basic EOQ model the variable cost <math>\,c</math> is constant for orders of all sizes. However, it is common for suppliers to offer price breaks for large orders. This section shows how to extend the EOQ model to incorporate such quantity discounts. Actually, there are two kinds of discounts, incremental and all-units. | In the basic EOQ model the variable cost <math>\,c</math> is constant for orders of all sizes. However, it is common for suppliers to offer price breaks for large orders. This section shows how to extend the EOQ model to incorporate such quantity discounts. Actually, there are two kinds of discounts, incremental and all-units. | ||

| - | |||

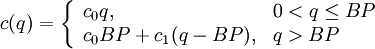

Consider the first case: Suppose the purchase price changes at the breakpoint <math>\,BP</math> | Consider the first case: Suppose the purchase price changes at the breakpoint <math>\,BP</math> | ||

| Line 8: | Line 7: | ||

Thus, the total order cost is | Thus, the total order cost is | ||

| - | + | <math>\,k+c\left(q\right),</math> | |

where | where | ||

| - | + | <math>\,c(q)=\left\{\begin{array}{ll} {c_{0} q,} & {0<q\le BP} \\ {c_{0} BP+c_{1} (q-BP),} & {q>BP} \end{array}\right.</math> | |

| + | Alternatively, define <math>\,k_{0} =k</math> (a constant) and <math>\,k_{1} =k+(c_{0} -c_{1} )BP</math> (a constant!). Then, the order cost is | ||

| - | + | <math>\,k+c(q)=\left\{\begin{array}{ll} {k_{0} +c_{0} q,} & {0<q\le BP} \\ {k_{1} +c_{1} q,} & {q>BP} \end{array}\right. </math> | |

| - | + | ||

| - | + | ||

This function describes more elaborate economies of scale than the original fixed-plus-linear form. In a production setting, it represents costs that depend on the production quantity in a complex, nonlinear way. | This function describes more elaborate economies of scale than the original fixed-plus-linear form. In a production setting, it represents costs that depend on the production quantity in a complex, nonlinear way. | ||

| - | The figure illustrates | + | The figure illustrates <math>\,c(q)</math> for the incremental case. |

\begin{center} | \begin{center} | ||

| Line 30: | Line 28: | ||

Given the revised order cost for the incremental case, the formulation proceeds as in the EOQ model. The holding cost is a bit tricky, however. | Given the revised order cost for the incremental case, the formulation proceeds as in the EOQ model. The holding cost is a bit tricky, however. | ||

| - | In addition to direct handling costs, which occur at rate | + | In addition to direct handling costs, which occur at rate <math>\,\underline{h}</math>, there is also a financing cost, which occurs at rate <math>\,\alpha \frac{c(q)}{q} </math>. |

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| + | Here, <math>\,\alpha </math> is the interest rate, and <math>\,\frac{c(q)}{q} </math> is the average variable purchase cost. Thus, the total average cost is | ||

| + | <math>\,C(q)=\left[k+c(q)\right]\cdot \frac{\lambda }{q} +q\cdot \frac{1}{2} \cdot \left[\underline{h}+\alpha \cdot \frac{c(q)}{q} \right]</math> | ||

| + | (<math>\,C</math> is not differentiable at <math>\,q=BP</math>, so we cannot hope simply to differentiate to obtain the optimal solution. Also, <math>\,C</math> is not convex.) | ||

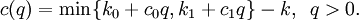

Observe that | Observe that | ||

| - | + | <math>\,c(q)=\min \{ k_{0} +c_{0} q,k_{1} +c_{1} q\} -k,\, \, \, q>0.</math> | |

| - | That is, | + | That is, <math>\,c(q)</math> is the smaller of two positive, linear functions that cross at <math>\,BP</math>. Therefore, |

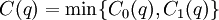

| - | + | <math>\,C(q)=\min \{ C_{0} (q),C_{1} (q)\} </math> | |

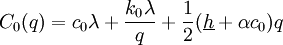

where | where | ||

| - | + | <math>\,C_{0} (q)=c_{0} \lambda +\frac{k_{0} \lambda }{q} +\frac{1}{2} (\underline{h}+\alpha c_{0} )q</math> | |

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

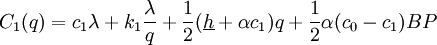

| - | + | <math>\,C_{1} (q)=c_{1} \lambda +k_{1} \frac{\lambda }{q} +\frac{1}{2} (\underline{h}+\alpha c_{1} )q+\frac{1}{2} \alpha (c_{0} -c_{1} )BP</math> | |

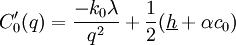

| - | + | Both <math>\,C_{0}</math> and <math>\,C_{1} </math> have the form of the EOQ model's cost function. Both are strictly convex and differentiable, and their graphs cross at <math>\,BP</math>. Let <math>\,q_{0}^{*}</math> and <math>\,q_{1}^{*}</math> be the respective minimizing values of <math>\,q</math>. Also, | |

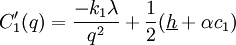

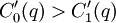

| - | + | <math>\,C'_{0} (q)=\frac{-k_{0} \lambda }{q^{2} } +\frac{1}{2} (\underline{h}+\alpha c_{0} )</math> | |

| + | <math>\,C'_{1} (q)=\frac{-k_{1} \lambda }{q^{2} } +\frac{1}{2} (\underline{h}+\alpha c_{1} )</math> | ||

| + | Evidently, <math>\,C'_{0} (q)>C'_{1} (q)</math>, so <math>\,q_{0}^{*} <q_{1}^{*}</math>. There remain three possible cases: | ||

\begin{enumerate} | \begin{enumerate} | ||

Revision as of 18:36, 20 May 2012

In the basic EOQ model the variable cost  is constant for orders of all sizes. However, it is common for suppliers to offer price breaks for large orders. This section shows how to extend the EOQ model to incorporate such quantity discounts. Actually, there are two kinds of discounts, incremental and all-units.

is constant for orders of all sizes. However, it is common for suppliers to offer price breaks for large orders. This section shows how to extend the EOQ model to incorporate such quantity discounts. Actually, there are two kinds of discounts, incremental and all-units.

Consider the first case: Suppose the purchase price changes at the breakpoint

The variable cost is  for any amount up to

for any amount up to  . For an order larger than

. For an order larger than  , the additional amount over

, the additional amount over  incurs the rate

incurs the rate  where

where  .

.

Thus, the total order cost is

where

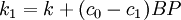

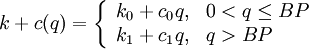

Alternatively, define  (a constant) and

(a constant) and  (a constant!). Then, the order cost is

(a constant!). Then, the order cost is

This function describes more elaborate economies of scale than the original fixed-plus-linear form. In a production setting, it represents costs that depend on the production quantity in a complex, nonlinear way.

The figure illustrates  for the incremental case.

for the incremental case.

\begin{center} \includegraphics[width=11 cm]{1.eps} \end{center}

Given the revised order cost for the incremental case, the formulation proceeds as in the EOQ model. The holding cost is a bit tricky, however.

In addition to direct handling costs, which occur at rate  , there is also a financing cost, which occurs at rate

, there is also a financing cost, which occurs at rate  .

.

Here,  is the interest rate, and

is the interest rate, and  is the average variable purchase cost. Thus, the total average cost is

is the average variable purchase cost. Thus, the total average cost is

![\,C(q)=\left[k+c(q)\right]\cdot \frac{\lambda }{q} +q\cdot \frac{1}{2} \cdot \left[\underline{h}+\alpha \cdot \frac{c(q)}{q} \right]](/images/math/4/f/a/4faa90a09d8be0549abcca49a234d5e6.png)

( is not differentiable at

is not differentiable at  , so we cannot hope simply to differentiate to obtain the optimal solution. Also,

, so we cannot hope simply to differentiate to obtain the optimal solution. Also,  is not convex.)

is not convex.)

Observe that

That is,  is the smaller of two positive, linear functions that cross at

is the smaller of two positive, linear functions that cross at  . Therefore,

. Therefore,

where

Both  and

and  have the form of the EOQ model's cost function. Both are strictly convex and differentiable, and their graphs cross at

have the form of the EOQ model's cost function. Both are strictly convex and differentiable, and their graphs cross at  . Let

. Let  and

and  be the respective minimizing values of

be the respective minimizing values of  . Also,

. Also,

Evidently,

Evidently,  , so

, so  . There remain three possible cases:

. There remain three possible cases:

\begin{enumerate} \item $q_{0}^{*} <q_{1}^{*} \le BP$ \item $q_{0}^{*} <BP\le q_{1}^{*} $ \item $BP\le q_{0}^{*} <q_{1}^{*} $ \end{enumerate}

In case 1, for $q\ge BP$,

$$C(q)=C_{1} (q)\ge C_{1} (BP)=C_{0} (BP)>C_{0} (q_{0}^{*} )$$

so $q_{0}^{*} $ is optimal. In case 3, by a parallel argument, $q_{1}^{*} $ is optimal. Only in case 2 is there any doubt. In that case, calculate both $C_{0} (q_{0}^{*} )$ and $C_{1} (q_{1}^{*} )$ to determine which one is smaller.

In sum, it is easy to determine an optimal policy: Compute both $q_{0}^{*} $ and $q_{1}^{*} $ using EOQ-like formulas, compare them with $BP$ to determine which case applies, and if necessary (in case 2) compare their costs.