Documentary collection

From Supply Chain Management Encyclopedia

Russian: Документарное инкассо

Contents |

General Provisions [1] [2]

A documentary collection (D/C) is the trade transaction in which the exporter hands over the task of collecting payment for goods supplied to his or her bank, which sends the shipping documents to the importer’s bank together with payment instructions. A documentary collection is so-called because the exporter receives payment from the importer in exchange for the shipping documents, with the funds and documents channeled through their respective banks. While D/Cs are less complicated and cheaper than letters of credit, they are riskier for exporters because they do not have a verification process and offer limited recourse if the importer does not pay. They are therefore only recommended in situations where the exporter and importer have a long-standing trade relationship. D/Cs involve the use of a draft that requires the importer to pay the face amount either on sight (document against payment—D/P) or on a specified date in the future (document against acceptance—D/A). The draft lists instructions that specify the documents required for the transfer of title to the goods. Although banks do act as facilitators for their clients under collections, documentary collections offer no verification process and limited recourse in the event of nonpayment. Drafts are generally less expensive than letters of credit (LCs).

Possibilities and advantages of D/Cs [3]:

- Make international trade operations more flexible.

- Use Documentary Collection in cases when the seller does not want to deliver goods to the buyer on "open account" basis, but due to a long-term stable business relationship between the parties there is no need for security provided by a Letter of Credit or payment guarantee.

- Documentary collection is suitable to the seller:

- if the seller has no doubts about the buyer's ability to meet its payment obligations,

- if the political and economic situation in the buyer's country is stable,

- if there are no foreign exchange restrictions in the seller's country.

- Documentary collection is convenient for the buyer because:

- there is no need for an advance payment; payment for goods can be made when shipping documents have been received,

- in cases of documents released against acceptance the buyer has the possibility to sell the goods first and afterwards make payment to the seller.

- Documentary Collection assures the seller that the shipping documents will be released to the buyer only upon payment or acceptance of a Bill of Exchange.

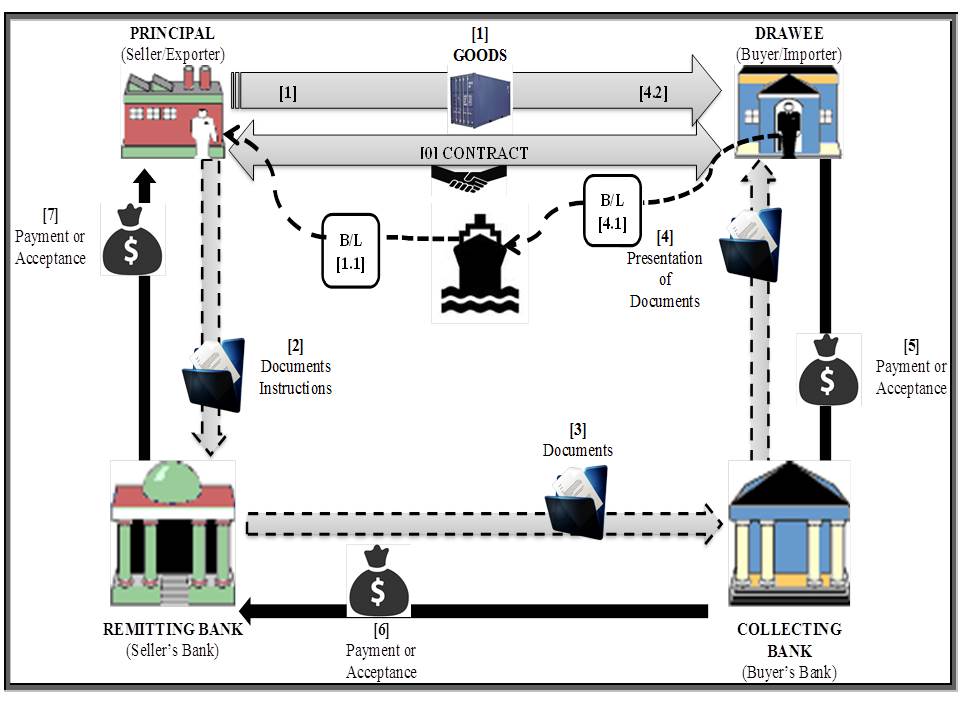

Diagram of Typical Simplified D/C Transaction Flow

LEGEND FOR THE DIAGRAM ABOVE

1. The exporter [0] enters an export contract with his or her overseas buyer.

2. The exporter [1] ships the goods to the importer through a freight forwarder (+carrier) and [1.1] receives in exchange the documents (including the main title document - a clean bill of lading).

3. The exporter [2] presents the documents with instructions for obtaining payment to the Seller’s Bank.

4. Seller’s Bank [3] sends the documents to the importer’s collecting bank.

5. The collecting bank [4] releases the documents to the importer [5 – “Payment”] upon receipt of payment (case of D/P – “documents against payment”) or [5 – “Acceptance”] on acceptance of draft from the importer (case of D/P – “documents against acceptance”).

6. The importer then [4.1] presents the documents to the carrier in [4.2] exchange for the goods.

7. Having received payment [5], the collecting bank (Buyer’s Bank) [6] forwards proceeds to the Seller’s Bank.

8. Once payment is received, the Seller’s Bank [7] credits the exporter’s account.

Pros and Cons of Documentary Collections[4]

| PROS | CONS |

| May increase Seller's market competitiveness, as this payment method is relatively low risk for overseas buyers and may also help their cash flow | Seller's risk of non-payment after delivery of his or her goods may be greater than in some other payment methods. If Seller's bill of exchange specifies payment at a date after delivery, he or she hands over control of the goods but run the risk of non-payment on the due date |

| A simpler, faster and cheaper method of payment than a documentary credit (L/C). | The banks don’t verify the shipping documents or guarantee payment by the correspondent buyer. However, the said buyer’s bank may add its ‘aval’ [5](guarantee) in relation to the bill of exchange |

| Seller retains title to the goods until his or her buyer accepts the bill of exchange | May strain seller's cash flow, especially if the bill of exchange provides for extended credit terms. However, to help the said seller to finance the export order, seller's bank may agree to pay seller the value of the bill of exchange (minus bank fees and interest) before it’s honoured by the correspondent buyer |

| If the correspondent buyer fails to honour the bill of exchange (and so doesn’t pay the seller), the seller can take legal action against the said buyer in accordance with laws governing the bill of exchange | If the correspondent buyer doesn’t accept the bill of exchange, or delays or defaults on payment, the seller may incur unplanned expenses such as storing, disposing of or redirecting the goods |

| If the export contract is in a foreign currency, the seller is exposed to exchange rate risk from the date of the sale contract to the time of payment | |

| REMINDER ONE:In a documentary collection transaction, a time draft is a promissory note that the importer has to pay a number of days (30, 60, 90, or 180 days) after it accepts the draft by signing it; and a date draft is a promissory note that the importer has to pay a number of days (30, 60, 90, or 180 days) after the exporter ships the goods. | REMINDER TWO:In a documentary collection or a letter of credit transaction, a sight draft is a promise by the importer that it will pay immediately, “at sight.” |

References

- ↑ Documentary Collection - http://www.investopedia.com/terms/d/documentary-collection.asp

- ↑ Trade Finance Guide: A guide and overview to Export Financing - http://www.tfrec.wsu.edu/pdfs/P2369.pdf

- ↑ Documentary Collection - https://www.swedbank.lv/en/pakalpojumi_uznemumiem/dokumentu_inkaso

- ↑ Documentary Collection - Export Finance Navigator - http://www.exportfinance.gov.au/Pages/Documentarycollection.aspx#content

- ↑ An aval is a promise by the presenting bank that the importer will honor the draft and that, should the importer default, the bank will make the payment. The bank therefore acts as a “co-signer” of the draft – David, P.A., Stewart, R.D. International Logistics: Management of International Trade Operations, Cengage Learning, 2010 – p.154