Countertrading

From Supply Chain Management Encyclopedia

(→Classification “Tree” of Countertrading Forms) |

|||

| Line 15: | Line 15: | ||

Countertrade is inherently an ''ad hoc'' activity - practice varies according to local regulations and requirements, the nature of the goods to be exported and the current priorities of the parties involved. Also, the terms used to describe the main modes of trading vary, often interchangeably causing confusion. However, the most common forms of countertrade and the terms most usually applied are as follows<ref> London Countertrade Roundtable - http://www.londoncountertrade.org/countertradefaq.htm </ref>: | Countertrade is inherently an ''ad hoc'' activity - practice varies according to local regulations and requirements, the nature of the goods to be exported and the current priorities of the parties involved. Also, the terms used to describe the main modes of trading vary, often interchangeably causing confusion. However, the most common forms of countertrade and the terms most usually applied are as follows<ref> London Countertrade Roundtable - http://www.londoncountertrade.org/countertradefaq.htm </ref>: | ||

| + | |||

| + | '''[[Buyback]]'''. Here, suppliers of capital plant or equipment agree to be paid by the future output of the investment concerned. For example exporters of equipment for a chemical plant may be repaid with part of the resulting output from the factory. This practice is most common with exports of process plant, mining equipment and similar orders. Buyback arrangements tend to be much longer term and for larger amounts than counterpurchase or barter deals. | ||

==References== | ==References== | ||

Revision as of 00:07, 23 September 2012

Russian: Встречная торговля

Introduction

Countertrade is an umbrella term covering a wide range of commercial mechanisms for reciprocal trade. It can manifest itself in several forms but always involves payment being made, at least partially, in goods or services instead of money. It often occurs when multinationals sell to a customer abroad and that customer pays by providing goods to the multinational. In some countries,countertrade is a condition of the buying organisation importing goods from elsewhere [1]. There are many forms of countertrading, ranging from simple barter agreements to complex offset deals that involve the exporter agreeing to compensatory practices with respect to the buyer. Countertrading commonly takes place between private companies in developed nations and the governments of developing countries, although countertrading also occurs between developed nations. It has become popular as a means of financing international trade to reduce risks or overcome problems associated with various national currencies[2].

Throughout history countertrading and barter [3] occurred whenever there was a shortage of money, or before money even existed. In modern times, countertrading arose as a means of conducting international trade when money was scarce, currencies couldn't be converted, or they were subject to inflationary and deflationary swings in value. In Germany between the two World Wars and after World War II, money was scarce and countertrading and barter became a way of conducting international trade. Eastern European countries followed Germany's lead and employed countertrading to overcome the problems of their own nonconvertible currencies. It was a practice that was favored by the centrally planned Eastern European economies. In the 1990s Eastern Europe and the countries of the former Soviet Union began countertrading with Western nations to overcome difficulties associated with their currencies.

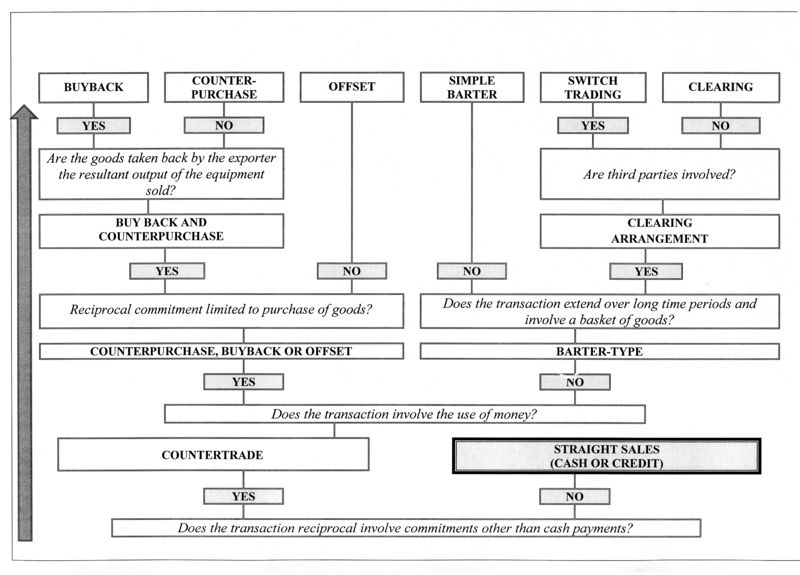

Classification “Tree” of Countertrading Forms

Countertrade is inherently an ad hoc activity - practice varies according to local regulations and requirements, the nature of the goods to be exported and the current priorities of the parties involved. Also, the terms used to describe the main modes of trading vary, often interchangeably causing confusion. However, the most common forms of countertrade and the terms most usually applied are as follows[4]:

Buyback. Here, suppliers of capital plant or equipment agree to be paid by the future output of the investment concerned. For example exporters of equipment for a chemical plant may be repaid with part of the resulting output from the factory. This practice is most common with exports of process plant, mining equipment and similar orders. Buyback arrangements tend to be much longer term and for larger amounts than counterpurchase or barter deals.

References

- ↑ Countertrade - CIPS Knowledge Works - http://www.cips.org/Documents/Resources/Knowledge%20Summary/Countertrade.pdf - accessed 05/09/2012

- ↑ Countertrading http://www.referenceforbusiness.com/encyclopedia/Cos-Des/Countertrading.html#ixzz27DpA3fwg

- ↑ Countertrading // Reference for Business: Encyclopedia of Business - http://www.referenceforbusiness.com/encyclopedia/Cos-Des/Countertrading.html#ixzz0uhqG14cn - accessed 05/08/2012

- ↑ London Countertrade Roundtable - http://www.londoncountertrade.org/countertradefaq.htm