Countertrading

From Supply Chain Management Encyclopedia

(→Countertrading Forms) |

(→Countertrading Forms) |

||

| (9 intermediate revisions not shown) | |||

| Line 6: | Line 6: | ||

| - | Throughout history<ref> Whitten,J. The History of Countertrading - http://www.ehow.com/facts_7151203_history-countertrading.html </ref> countertrading and barter <ref> Countertrading // Reference for Business: Encyclopedia of Business - http://www.referenceforbusiness.com/encyclopedia/Cos-Des/Countertrading.html#ixzz0uhqG14cn - accessed 05/08/2012 </ref> occurred whenever there was a shortage of money, or before money even existed. In modern times, countertrading arose as a means of conducting international trade when money was scarce, currencies couldn't be converted, or they were subject to inflationary and deflationary swings in value. In Germany between the two World Wars and after World War II, money was scarce and countertrading and barter became a way of conducting international trade. Eastern European countries followed Germany's lead and employed countertrading to overcome the problems of their own nonconvertible currencies. It was a practice that was favored by the centrally planned Eastern European economies. In the 1990s Eastern Europe and the countries of the former Soviet Union began countertrading with Western nations to overcome difficulties associated with their currencies. That time, Chinese government forced strictly Chinese importers to conclude such contracts where not less than 40% was to be effectuated by barter using Chinese items. There are no world statistics on countertradingб especially due to the very enigmatic nature of international offsets. However, different expert assessments are from 15% то 40% and an estimated 130 countries are doing almost US$500 billion assessment of value of global trade under counter-trade-related schemes<ref> Cate, W. 21st Century Counter Trade - http://www.exportauthority.com/21st-Century-Counter-Trade.html </ref>. | + | Throughout history <ref> Whitten,J. The History of Countertrading - http://www.ehow.com/facts_7151203_history-countertrading.html </ref> countertrading and barter <ref> Countertrading // Reference for Business: Encyclopedia of Business - http://www.referenceforbusiness.com/encyclopedia/Cos-Des/Countertrading.html#ixzz0uhqG14cn - accessed 05/08/2012 </ref> occurred whenever there was a shortage of money, or before money even existed. In modern times, countertrading arose as a means of conducting international trade when money was scarce, currencies couldn't be converted, or they were subject to inflationary and deflationary swings in value. In Germany between the two World Wars and after World War II, money was scarce and countertrading and barter became a way of conducting international trade. Eastern European countries followed Germany's lead and employed countertrading to overcome the problems of their own nonconvertible currencies. It was a practice that was favored by the centrally planned Eastern European economies. In the 1990s Eastern Europe and the countries of the former Soviet Union began countertrading with Western nations to overcome difficulties associated with their currencies. That time, Chinese government forced strictly Chinese importers to conclude such contracts where not less than 40% was to be effectuated by barter using Chinese items. There are no world statistics on countertradingб especially due to the very enigmatic nature of international offsets. However, different expert assessments are from 15% то 40% and an estimated 130 countries are doing almost US$500 billion assessment of value of global trade under counter-trade-related schemes<ref> Cate, W. 21st Century Counter Trade - http://www.exportauthority.com/21st-Century-Counter-Trade.html </ref>. |

| - | == Comparative Analysis between Traditional and Counter Trade Export Models <ref> Cate, W. ibid. </ref>== | + | == '''Comparative Analysis between Traditional and Counter Trade Export Models''' <ref> Cate, W. ibid. </ref>== |

'''The Traditional Export Model'''. The Exporter will move to Reno and include the export business in Nevada. Their doing business is to export American-made computer microchips. They have a buyer in Singapore offering a 90 Irrevocable Letter of Credit (ILC) and their manufacturer is willing to defer payment for 90 days. They buy $200,000 worth of microchips, airship them and sell them in Singapore for $275,000. Ninety days later, they have a gross profit of $75,000 and a pretax profit of $66,000. After paying U.S. Federal income taxation , they earn about $44,800. Since they can repeat the microchip export four times each year, their after taxation profit is nearly $100,000. This is more funds than the majority of all the people earn living in Nevada. Not bad. | '''The Traditional Export Model'''. The Exporter will move to Reno and include the export business in Nevada. Their doing business is to export American-made computer microchips. They have a buyer in Singapore offering a 90 Irrevocable Letter of Credit (ILC) and their manufacturer is willing to defer payment for 90 days. They buy $200,000 worth of microchips, airship them and sell them in Singapore for $275,000. Ninety days later, they have a gross profit of $75,000 and a pretax profit of $66,000. After paying U.S. Federal income taxation , they earn about $44,800. Since they can repeat the microchip export four times each year, their after taxation profit is nearly $100,000. This is more funds than the majority of all the people earn living in Nevada. Not bad. | ||

| Line 19: | Line 19: | ||

'''Conclusion'''. Counter Trades are potentially five times more profitable than the traditional export model. However, it takes ten times or more effort to setup a series of successful barter trades (if any). | '''Conclusion'''. Counter Trades are potentially five times more profitable than the traditional export model. However, it takes ten times or more effort to setup a series of successful barter trades (if any). | ||

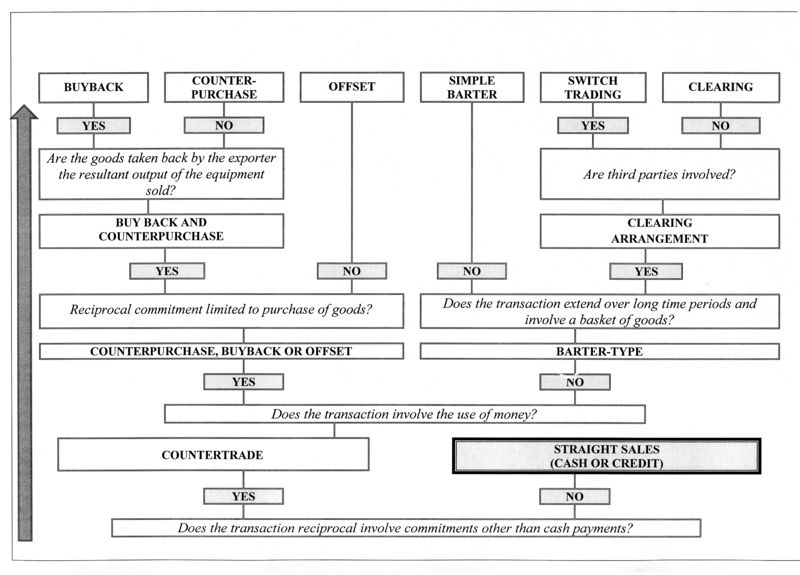

| - | == Classification “Tree” of Countertrading Forms <ref> Kotabe, M., Helsen, K. Global Marketing Management. – John Wiley & Sons, Inc., New York, etc., 2001 – p.441, Ex.13-8. – Redesigned. </ref>== | + | == '''Classification “Tree” of Countertrading Forms''' <ref> Kotabe, M., Helsen, K. Global Marketing Management. – John Wiley & Sons, Inc., New York, etc., 2001 – p.441, Ex.13-8. – Redesigned. </ref>== |

[[File:COUNTERTRADING_E.jpeg|800px]] | [[File:COUNTERTRADING_E.jpeg|800px]] | ||

| - | |||

== '''Countertrading Forms''' == | == '''Countertrading Forms''' == | ||

| Line 32: | Line 31: | ||

'''[[Buyback]]'''. Here, suppliers of capital plant or equipment agree to be paid by the future output of the investment concerned. For example exporters of equipment for a chemical plant may be repaid with part of the resulting output from the factory. This practice is most common with exports of process plant, mining equipment and similar orders. Buyback arrangements tend to be much longer term and for larger amounts than counterpurchase or barter deals. | '''[[Buyback]]'''. Here, suppliers of capital plant or equipment agree to be paid by the future output of the investment concerned. For example exporters of equipment for a chemical plant may be repaid with part of the resulting output from the factory. This practice is most common with exports of process plant, mining equipment and similar orders. Buyback arrangements tend to be much longer term and for larger amounts than counterpurchase or barter deals. | ||

| - | '''Counterpurchase'''. In a counterpurchase agreement,a foreign supplier undertakes to purchase goods and services from the purchasing country as a condition of securing the order. There will be a contract for the principal supply, paid on normal cash or credit terms - and there will be a separate agreement to cover the counterpurchased goods (also bought on normal cash or credit terms). The counterpurchase agreement can vary from a general declaration oF intent, to a binding contract specifying the goods and services to be supplied, the markets in which they may be sold, and the penalties for non-performance. The value of the counterpurchase undertaking may vary in value between 10% and 100% (or more) of the original export order. | + | '''[[Counterpurchase]]'''. In a counterpurchase agreement,a foreign supplier undertakes to purchase goods and services from the purchasing country as a condition of securing the order. There will be a contract for the principal supply, paid on normal cash or credit terms - and there will be a separate agreement to cover the counterpurchased goods (also bought on normal cash or credit terms). The counterpurchase agreement can vary from a general declaration oF intent, to a binding contract specifying the goods and services to be supplied, the markets in which they may be sold, and the penalties for non-performance. The value of the counterpurchase undertaking may vary in value between 10% and 100% (or more) of the original export order. |

Counterpurchase is generally imposed for two reasons: first, to stimulate exports and second, to alleviate the balance of payment deficit resultinig from imported goods. | Counterpurchase is generally imposed for two reasons: first, to stimulate exports and second, to alleviate the balance of payment deficit resultinig from imported goods. | ||

| - | '''Offset'''. Offset has traditionally been used by governments around the world when they have made major purchases of military goods but is becoming increasingly common in other sectors. There are two distinct types: | + | '''[[Offset]]'''. Offset has traditionally been used by governments around the world when they have made major purchases of military goods but is becoming increasingly common in other sectors. There are two distinct types: |

* ''direct offset'': here the supplier agrees to incorporate materials, components or sub-assemblies which are procured from the importing country. In some large contracts, successful bidders may be required to establish local production. Direct offset has been particularly common for trade in defence systems and aircraft. | * ''direct offset'': here the supplier agrees to incorporate materials, components or sub-assemblies which are procured from the importing country. In some large contracts, successful bidders may be required to establish local production. Direct offset has been particularly common for trade in defence systems and aircraft. | ||

| Line 46: | Line 45: | ||

The objective of stimulating civil investments is to increase, diversify and support the industrial base. These investments may be in manufacturing ventures, infrastructure, or training, and may be totally different in nature to the original sale (e.g. investment in a chipboard factory might be used to offset the sale of aeroengines). | The objective of stimulating civil investments is to increase, diversify and support the industrial base. These investments may be in manufacturing ventures, infrastructure, or training, and may be totally different in nature to the original sale (e.g. investment in a chipboard factory might be used to offset the sale of aeroengines). | ||

| - | '''Barter'''. In a barter deal, goods are exchanged for goods - the principal export is paid for with goods (or services) from the importing market. A single contract covers both flows and in the simpler case, no cash is involved<ref> SAMPLE BARTER CONTRACT/EXCHANGE AGREEMENT - http://www.pmmy.com/Bartering_Sample_Contract.pdf </ref>. In practice, however, the supply of the principal export is often released only when the sale of the bartered goods has generated sufficient cash. | + | '''[[Barter]]'''. In a barter deal, goods are exchanged for goods - the principal export is paid for with goods (or services) from the importing market. A single contract covers both flows and in the simpler case, no cash is involved<ref> SAMPLE BARTER CONTRACT/EXCHANGE AGREEMENT - http://www.pmmy.com/Bartering_Sample_Contract.pdf </ref>. In practice, however, the supply of the principal export is often released only when the sale of the bartered goods has generated sufficient cash. |

Barter is often the main means of trading in subsistence economies and in cross border trade in undeveloped regions of the world. More developed markets use it in international trade where they have commodities to offer. which are accessible to world markets. Barter may also be introduced into existing contracts to recover debts i.e. when the original payment terms have failed. | Barter is often the main means of trading in subsistence economies and in cross border trade in undeveloped regions of the world. More developed markets use it in international trade where they have commodities to offer. which are accessible to world markets. Barter may also be introduced into existing contracts to recover debts i.e. when the original payment terms have failed. | ||

| - | '''Switch Trading'''. Imbalances in long term bilateral trading agreements sometimes lead to the | + | '''[[Switch Trading]]'''. Imbalances in long term bilateral trading agreements sometimes lead to the accumulation of uncleared credit surpluses in one or other country, For example, Brazil at one time had a large credit surplus with Poland. These surpluses can sometimes be tapped by third countries so that, for example UK exports to Brazil could be financed from the sale of Polish goods to the UK or elsewhere. Such transactions are known as ‘switch' or ‘swap' deals because they typically involve switching the documentation (and destination) of goods on the high seas. |

| - | + | ||

| - | + | ||

| - | '''Clearing'''. A clearing arrangement is a form of barter in which the counterparties contract to purchase a certain amount of goods and services from one another. Both parties set up accounts with each other that are debited whenever one country imports from the other. The clearing arrangement introduces the concept of credit to barter transactions, and means bilateral trade can take place that does not have to be immediately settled | + | '''[[Clearing]]'''. A clearing arrangement is a form of barter in which the counterparties contract to purchase a certain amount of goods and services from one another. Both parties set up accounts with each other that are debited whenever one country imports from the other. The clearing arrangement introduces the concept of credit to barter transactions, and means bilateral trade can take place that does not have to be immediately settled |

==References== | ==References== | ||

Latest revision as of 21:32, 26 July 2014

Russian: Встречная торговля

Contents |

Introduction

Countertrade is an umbrella term covering a wide range of commercial mechanisms for reciprocal trade. It can manifest itself in several forms but always involves payment being made, at least partially, in goods or services instead of money. It often occurs when multinationals sell to a customer abroad and that customer pays by providing goods to the multinational. In some countries,countertrade is a condition of the buying organisation importing goods from elsewhere [1]. There are many forms of countertrading, ranging from simple barter agreements to complex offset deals that involve the exporter agreeing to compensatory practices [2]with respect to the buyer. Countertrading commonly takes place between private companies in developed nations and the governments of developing countries, although countertrading also occurs between developed nations. It has become popular as a means of financing international trade to reduce risks or overcome problems associated with various national currencies[3].

Throughout history [4] countertrading and barter [5] occurred whenever there was a shortage of money, or before money even existed. In modern times, countertrading arose as a means of conducting international trade when money was scarce, currencies couldn't be converted, or they were subject to inflationary and deflationary swings in value. In Germany between the two World Wars and after World War II, money was scarce and countertrading and barter became a way of conducting international trade. Eastern European countries followed Germany's lead and employed countertrading to overcome the problems of their own nonconvertible currencies. It was a practice that was favored by the centrally planned Eastern European economies. In the 1990s Eastern Europe and the countries of the former Soviet Union began countertrading with Western nations to overcome difficulties associated with their currencies. That time, Chinese government forced strictly Chinese importers to conclude such contracts where not less than 40% was to be effectuated by barter using Chinese items. There are no world statistics on countertradingб especially due to the very enigmatic nature of international offsets. However, different expert assessments are from 15% то 40% and an estimated 130 countries are doing almost US$500 billion assessment of value of global trade under counter-trade-related schemes[6].

Comparative Analysis between Traditional and Counter Trade Export Models [7]

The Traditional Export Model. The Exporter will move to Reno and include the export business in Nevada. Their doing business is to export American-made computer microchips. They have a buyer in Singapore offering a 90 Irrevocable Letter of Credit (ILC) and their manufacturer is willing to defer payment for 90 days. They buy $200,000 worth of microchips, airship them and sell them in Singapore for $275,000. Ninety days later, they have a gross profit of $75,000 and a pretax profit of $66,000. After paying U.S. Federal income taxation , they earn about $44,800. Since they can repeat the microchip export four times each year, their after taxation profit is nearly $100,000. This is more funds than the majority of all the people earn living in Nevada. Not bad.

The Counter Trade Model. The Exporter incorporates their Counter Trade business in Belize. Their business office is in Barbados. They have the identical relationship with an American computer microchip manufacturer. They have a buyer in Singapore offering to barter their computers for the American microchips. They have an importer in Senegal willing to take the computers and pay for them in high quality textiles that a buyer in London wants and will pay for in 75-year-old scotch. And, they have a gem broker in South Africa who wants the scotch against a payment in uncut diamonds. The counter trader has a deal with a diamond dealer in Toronto. The Canadian wholesaler has retail buyers in the States, who want the diamond rough.

The Counter Trader buys $200,000 assessment of worth of American microchips and trades them in Singapore for $275,000 in computers. He ships the computers to Senegal as the Senegal buyer surface ships the textiles to France (no import duty on Senegal exports to France) and from La Harve, the textiles are surface shipped to Portsmouth. The London textile buyer air ships the scotch to Cape Town as the South African liquor buyer air ships the uncut diamonds to Toronto. The Canadian gem dealer distributes the stones to his American retail buyers. The Counter Trader starts with a $200,000 purchase. In Singapore, hes paid $275,000 in computers. In Senegal, he collects $352,000 in textiles. In England, he gets $450,000 in Scotch. In South Africa, he takes in $576,000 in uncut gems. In Canada, he is paid $738,000 for the uncut diamonds in cash. His pretax profit is $243,000. Since Canada has a double taxation treaty with Barbados, he pays the Barbados 8% income taxation on his profit. Our Counter Traders after-tax profit is about $224,000. He or she might repeat this series of barter trades four times each year. The Counter Traders annual after tax income will be nearly a million dollars.

Conclusion. Counter Trades are potentially five times more profitable than the traditional export model. However, it takes ten times or more effort to setup a series of successful barter trades (if any).

Classification “Tree” of Countertrading Forms [8]

Countertrading Forms

Countertrade is inherently an ad hoc activity - practice varies according to local regulations and requirements, the nature of the goods to be exported and the current priorities of the parties involved. Also, the terms used to describe the main modes of trading vary, often interchangeably causing confusion. However, the most common forms of countertrade and the terms most usually applied are as follows[9] (from the left to the right as on the Classification "Tree" above):

Buyback. Here, suppliers of capital plant or equipment agree to be paid by the future output of the investment concerned. For example exporters of equipment for a chemical plant may be repaid with part of the resulting output from the factory. This practice is most common with exports of process plant, mining equipment and similar orders. Buyback arrangements tend to be much longer term and for larger amounts than counterpurchase or barter deals.

Counterpurchase. In a counterpurchase agreement,a foreign supplier undertakes to purchase goods and services from the purchasing country as a condition of securing the order. There will be a contract for the principal supply, paid on normal cash or credit terms - and there will be a separate agreement to cover the counterpurchased goods (also bought on normal cash or credit terms). The counterpurchase agreement can vary from a general declaration oF intent, to a binding contract specifying the goods and services to be supplied, the markets in which they may be sold, and the penalties for non-performance. The value of the counterpurchase undertaking may vary in value between 10% and 100% (or more) of the original export order.

Counterpurchase is generally imposed for two reasons: first, to stimulate exports and second, to alleviate the balance of payment deficit resultinig from imported goods.

Offset. Offset has traditionally been used by governments around the world when they have made major purchases of military goods but is becoming increasingly common in other sectors. There are two distinct types:

- direct offset: here the supplier agrees to incorporate materials, components or sub-assemblies which are procured from the importing country. In some large contracts, successful bidders may be required to establish local production. Direct offset has been particularly common for trade in defence systems and aircraft.

- indirect offset: here the purchaser requires suppliers to enter into long term industrial (and other) co-operation and investment but these are unconnnected to the supply contract and may be either defense related or in the civil sector.

The overall objective of offset either direct or indirect in the defence sector is generally to promote import substitution and to minimize the balance of payments deficit for military purchases by develojiing an indigenous industrial defense capability.

The objective of stimulating civil investments is to increase, diversify and support the industrial base. These investments may be in manufacturing ventures, infrastructure, or training, and may be totally different in nature to the original sale (e.g. investment in a chipboard factory might be used to offset the sale of aeroengines).

Barter. In a barter deal, goods are exchanged for goods - the principal export is paid for with goods (or services) from the importing market. A single contract covers both flows and in the simpler case, no cash is involved[10]. In practice, however, the supply of the principal export is often released only when the sale of the bartered goods has generated sufficient cash.

Barter is often the main means of trading in subsistence economies and in cross border trade in undeveloped regions of the world. More developed markets use it in international trade where they have commodities to offer. which are accessible to world markets. Barter may also be introduced into existing contracts to recover debts i.e. when the original payment terms have failed.

Switch Trading. Imbalances in long term bilateral trading agreements sometimes lead to the accumulation of uncleared credit surpluses in one or other country, For example, Brazil at one time had a large credit surplus with Poland. These surpluses can sometimes be tapped by third countries so that, for example UK exports to Brazil could be financed from the sale of Polish goods to the UK or elsewhere. Such transactions are known as ‘switch' or ‘swap' deals because they typically involve switching the documentation (and destination) of goods on the high seas.

Clearing. A clearing arrangement is a form of barter in which the counterparties contract to purchase a certain amount of goods and services from one another. Both parties set up accounts with each other that are debited whenever one country imports from the other. The clearing arrangement introduces the concept of credit to barter transactions, and means bilateral trade can take place that does not have to be immediately settled

References

- ↑ Countertrade - CIPS Knowledge Works - http://www.cips.org/Documents/Resources/Knowledge%20Summary/Countertrade.pdf - accessed 05/09/2012

- ↑ Global Compensation Practices // Survey of WorldatWork Members. September 2004. Conducted by WorldatWork and Watson Wyatt Worldwide - http://www.worldatwork.org/pub/globalsurvey04.pdf

- ↑ Countertrading http://www.referenceforbusiness.com/encyclopedia/Cos-Des/Countertrading.html#ixzz27DpA3fwg

- ↑ Whitten,J. The History of Countertrading - http://www.ehow.com/facts_7151203_history-countertrading.html

- ↑ Countertrading // Reference for Business: Encyclopedia of Business - http://www.referenceforbusiness.com/encyclopedia/Cos-Des/Countertrading.html#ixzz0uhqG14cn - accessed 05/08/2012

- ↑ Cate, W. 21st Century Counter Trade - http://www.exportauthority.com/21st-Century-Counter-Trade.html

- ↑ Cate, W. ibid.

- ↑ Kotabe, M., Helsen, K. Global Marketing Management. – John Wiley & Sons, Inc., New York, etc., 2001 – p.441, Ex.13-8. – Redesigned.

- ↑ London Countertrade Roundtable - http://www.londoncountertrade.org/countertradefaq.htm

- ↑ SAMPLE BARTER CONTRACT/EXCHANGE AGREEMENT - http://www.pmmy.com/Bartering_Sample_Contract.pdf